How to Budget 101

So, you just bought a house? Maybe you are on a new journey of discovering your finances and need help of where to start? One of our main goals here is to get you into a home (aka debt), but then help you get out of debt and be financially strong!

Where to Start

Budgeting can be overwhelming and scary if you have never done it before. The key with budgeting is being realistic with your basic needs and also sticking to the numbers you wrote down. If you can create a plan then stick with that plan, you will be a master before you know it.

When to Start

It can be fun and exciting to pull the trigger on your newly made budget, but before you do, we recommend simply keeping track of where you spend your money for at least one month before you become a Drill Sargent on yourself and your family. Just being aware of how much you spend in which categories before you give yourself boundaries will set you up for budgeting success by allowing you to see what is necessary and what is not so much. Once you track your spending for a month, now it’s time to start trimming down the areas that you aren’t so proud to talk about. This exercise will help you keep your lights on but also cut out that 4th cup of coffee at Starbucks everyday.

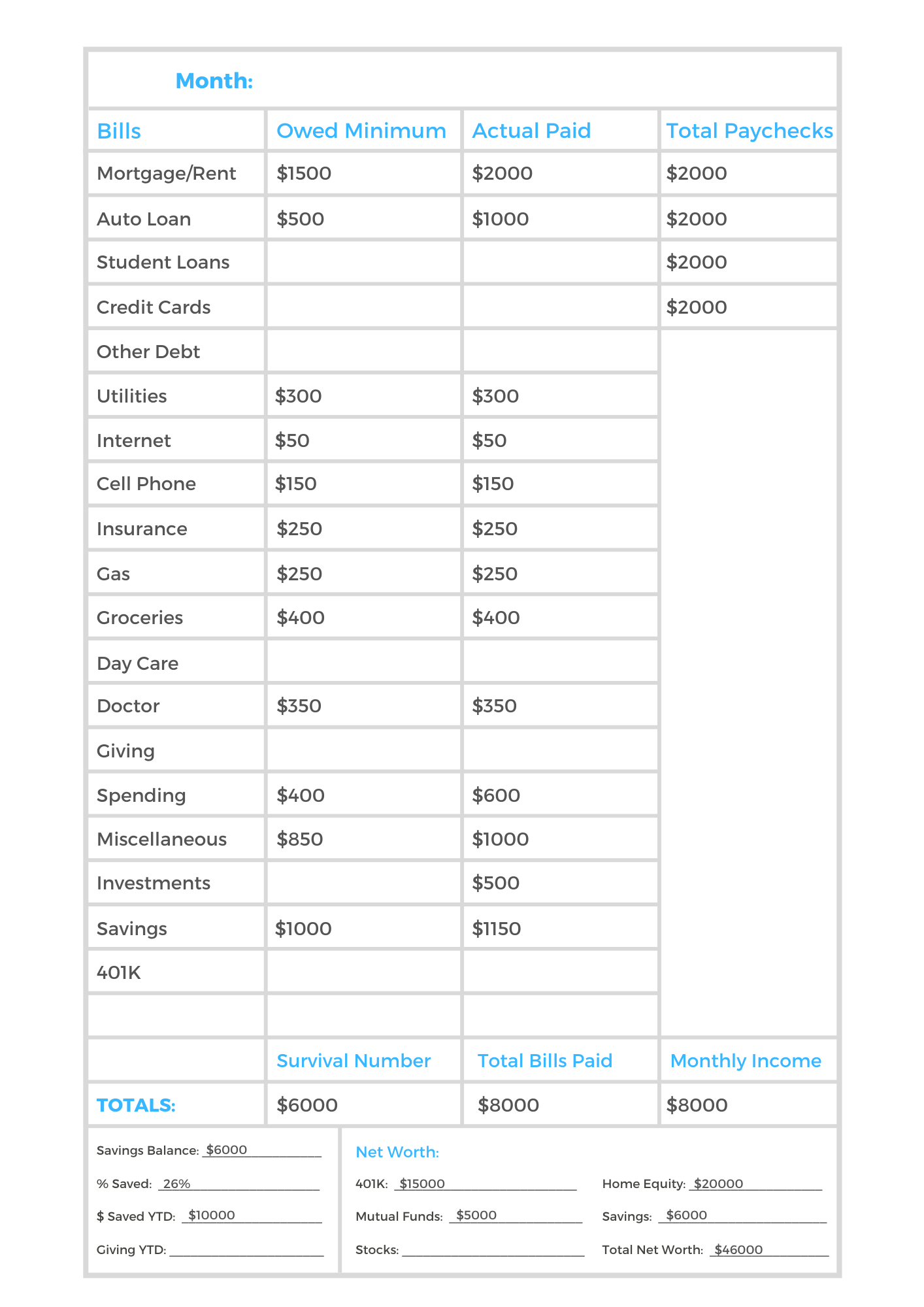

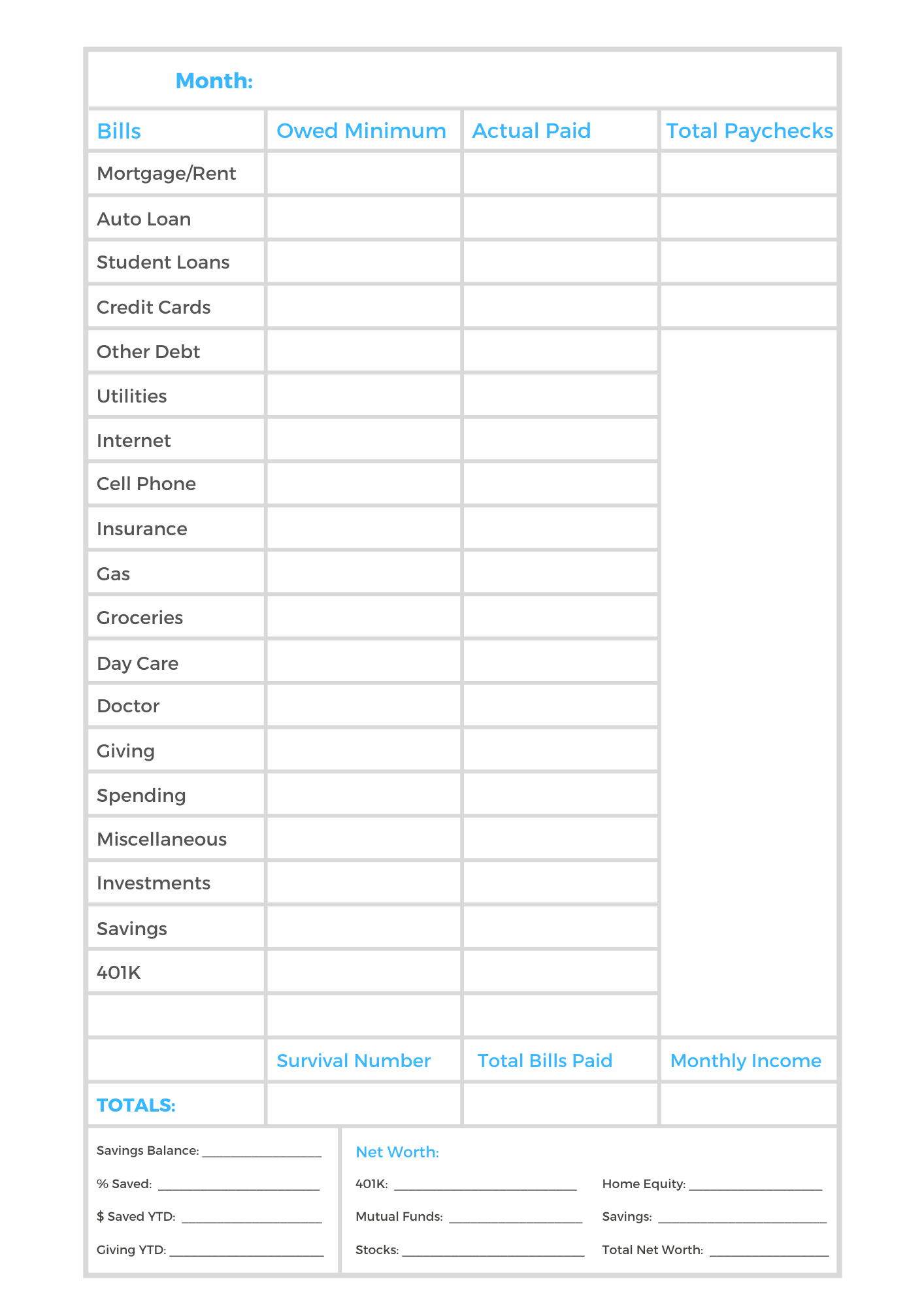

The Personal Budget

The Personal Budget will help give you a starting point to categorize the things that are essential to live each month and also things that can be trimmed or beefed up depending on your goals. It’s nice to see how your extra income can now start tackling debt, piling up in your savings account, or maybe it’s time to start investing. Remember, every dollar is important and should be claimed somewhere in your budget.

We want to see you succeed with your financial dreams! Please reach out to us here at 801-506-2700 if you have any questions about how the Personal Budget can work for you.